Arbus Capital Management Services

Arbus Capital Management provides a full range of investment management and investment advice. Whether potential clients have a significant and varied portfolio that requires full-time expert management, or a single question regarding a 401(k) investment choice, Arbus Capital Management may be the right choice.

Fees are based on either a percentage of assets under management, fixed fee or an hourly rate.

Non-Profits / Endowments / Foundations

The proper management of a small to midsized non-profit institution can be quite challenging. Your staff and board members may be experts in your core mission but may not be familiar with the intricacies of investing a substantial reserve or endowment.

We can assume the prudent management of your investment portfolio while simultaneously helping you fulfill your fiduciary duty. Below are just a few of the essential investment goals we can perform to put you on the path toward achieving your non-profit mission:

- Create or revise an investment policy statement (IPS)

- Develop asset allocation targets

- Determine an appropriate spending policy

- Implement an environmental, social and governance (ESG) mandate

If only it were this easy! We know you work hard for your funding and we will work just as hard to manage it properly to help you fulfill your mission.

Entrepreneurs / Executives

If you are an entrepreneur, executive, board member or high-tech worker then you are familiar with the challenges of managing a substantial holding of stock or stock options in a single company. We understand your situation. We have a background in high-tech and were one of the founders of a software company that was purchased in an all-stock transaction. Therefore, we are uniquely qualified to help you navigate the ups and downs of a concentrated stock position.

- As a fee-only, SEC registered investment advisor and a CFA charterholder we can assist with you the following:

- Determine when to exercise stock options

- Manage restricted stock holdings

- Attempt to mitigate the risk of a concentrated position through hedging or other methods

- Invest external portfolio holdings, before and after a liquidity event, to increase diversification and reduce volatility

- Strive for best execution when liquidating large blocks of company stock

- Coordinate with compliance and legal departments to adhere to company trading restrictions

- Ensure all required SEC paperwork is filed correctly (Form 4, Form 144, etc.)

- Work with trusts and estates attorneys to develop gifting and generational transfer strategies to minimize taxation

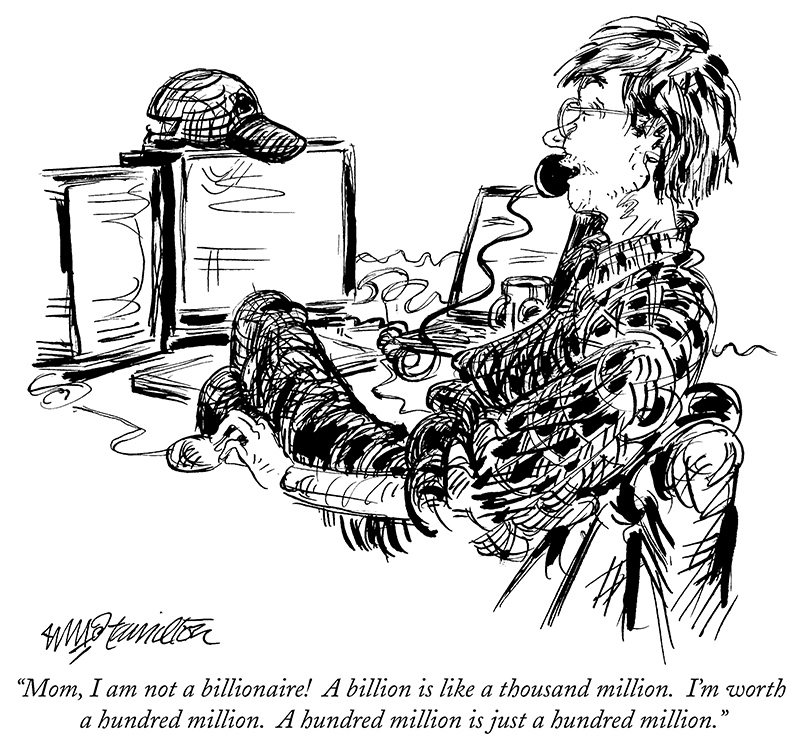

Questions to Ask About Stock Options

It is wonderful that your mom calls you, but you need to talk to a professional who understands your complex financial situation.

Individuals / Families

Whether you are trying to save for retirement, for your child’s college education or for a down payment on a new home we can help you to achieve your financial goals. As a fee-only, registered investment advisor we provide unbiased investment advice and investment management to our clients. We can help you with the following:

- 401(k), 403(b) and IRA rollovers

- Roth IRA conversions

- 529 college plan investments

- Retirement planning

- Diversification and reducing volatility

- Social Security optimization

- Investment risk assessment

- Low-cost ETF portfolio construction and diversification

- Tax aware investing

We don’t recommend these unusual retirement plans.